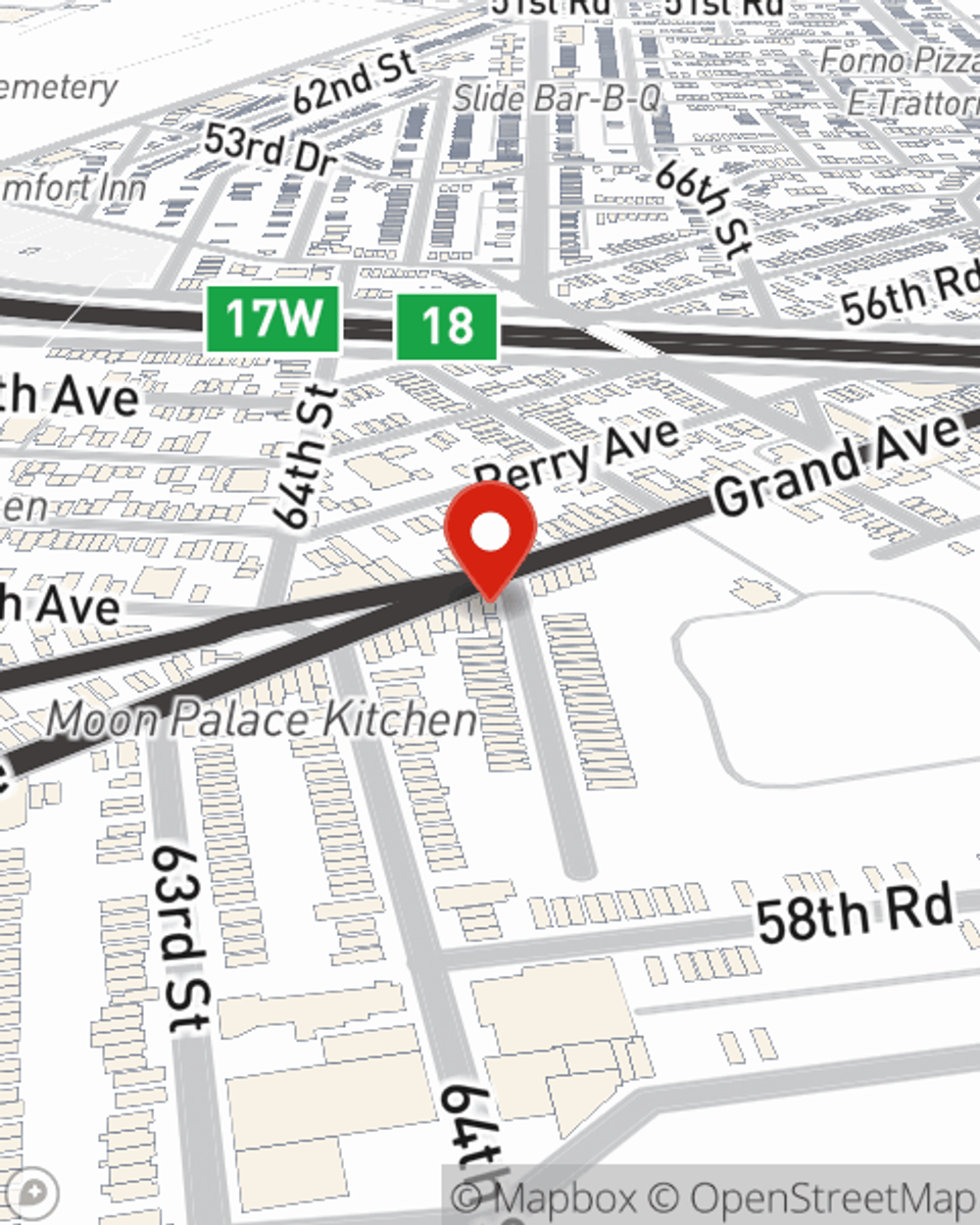

Business Insurance in and around Maspeth

One of Maspeth’s top choices for small business insurance.

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

Whether you own a a home cleaning service, a veterinarian, or a clock shop, State Farm has small business protection that can help. That way, amid all the different decisions and options, you can focus on your next steps.

One of Maspeth’s top choices for small business insurance.

Insure your business, intentionally

Cover Your Business Assets

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, builders risk insurance or artisan and service contractors.

The right coverages can help keep your business safe. Consider stopping by State Farm agent Jim Von Eiff's office today to discuss your options and get started!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Jim Von Eiff

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.